All Categories

Featured

Table of Contents

For the majority of people, the most significant trouble with the unlimited banking principle is that preliminary hit to very early liquidity brought on by the costs. Although this con of boundless financial can be decreased substantially with correct plan design, the initial years will always be the most awful years with any type of Whole Life policy.

That said, there are certain boundless banking life insurance policy plans designed primarily for high early cash money worth (HECV) of over 90% in the initial year. Nevertheless, the long-lasting efficiency will usually significantly lag the best-performing Infinite Financial life insurance policy policies. Having access to that extra 4 numbers in the first couple of years might come at the cost of 6-figures in the future.

You actually obtain some substantial long-term benefits that assist you redeem these early prices and then some. We find that this hindered very early liquidity issue with unlimited financial is much more psychological than anything else when extensively explored. Actually, if they definitely required every dime of the cash missing from their boundless banking life insurance policy in the initial couple of years.

Tag: unlimited financial concept In this episode, I talk concerning financial resources with Mary Jo Irmen who teaches the Infinite Financial Idea. With the increase of TikTok as an information-sharing system, economic suggestions and strategies have actually found a novel means of dispersing. One such strategy that has been making the rounds is the boundless banking principle, or IBC for short, garnering recommendations from celebs like rap artist Waka Flocka Fire.

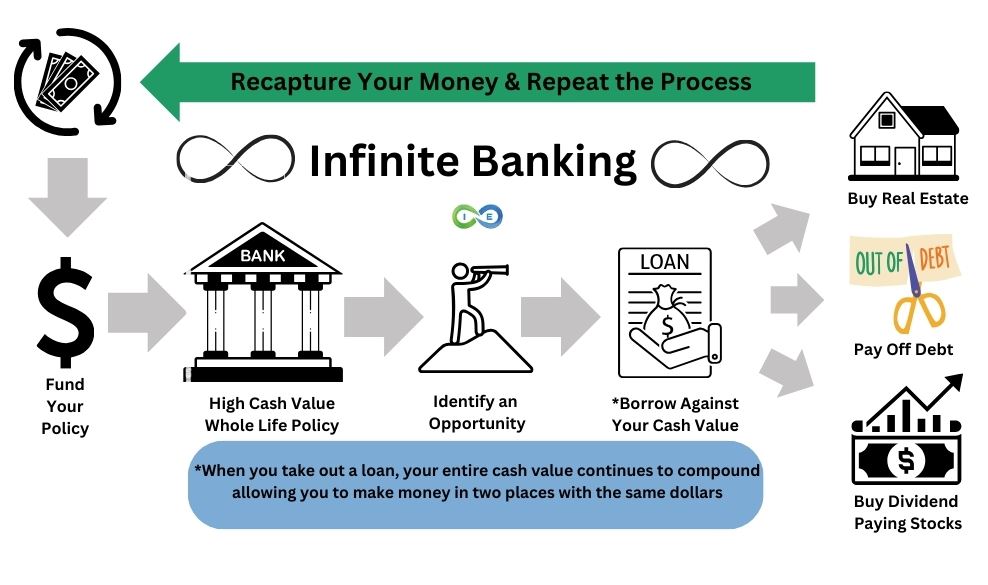

Within these policies, the cash money worth expands based upon a price set by the insurer. As soon as a significant cash money value accumulates, insurance policy holders can get a money value loan. These lendings differ from conventional ones, with life insurance policy acting as security, indicating one might shed their coverage if borrowing excessively without appropriate cash value to support the insurance coverage expenses.

And while the appeal of these plans is apparent, there are inherent constraints and risks, necessitating attentive money worth tracking. The technique's authenticity isn't black and white. For high-net-worth individuals or entrepreneur, particularly those using methods like company-owned life insurance policy (COLI), the advantages of tax breaks and compound growth might be appealing.

Infinite Banking Concept Pros And Cons

The allure of boundless banking does not negate its difficulties: Cost: The foundational requirement, a permanent life insurance plan, is pricier than its term equivalents. Eligibility: Not everybody gets approved for whole life insurance policy as a result of extensive underwriting procedures that can leave out those with details health or way of life conditions. Complexity and danger: The intricate nature of IBC, coupled with its dangers, may prevent numerous, particularly when simpler and less dangerous alternatives are available.

Alloting around 10% of your regular monthly revenue to the plan is just not practical for many people. Making use of life insurance policy as a financial investment and liquidity resource calls for self-control and surveillance of plan money worth. Seek advice from an economic expert to identify if infinite financial straightens with your top priorities. Part of what you review below is merely a reiteration of what has actually currently been claimed above.

Before you obtain on your own into a scenario you're not prepared for, recognize the adhering to first: Although the concept is commonly sold as such, you're not really taking a loan from on your own. If that held true, you wouldn't need to settle it. Rather, you're obtaining from the insurance policy business and have to settle it with passion.

Some social media sites articles advise using cash money worth from entire life insurance policy to pay for bank card financial obligation. The idea is that when you repay the lending with passion, the quantity will certainly be returned to your investments. That's not how it functions. When you pay back the financing, a part of that interest mosts likely to the insurance provider.

For the very first several years, you'll be paying off the payment. This makes it exceptionally challenging for your policy to build up worth throughout this moment. Whole life insurance policy expenses 5 to 15 times a lot more than term insurance. The majority of people merely can't manage it. So, unless you can manage to pay a few to numerous hundred dollars for the next years or even more, IBC will not benefit you.

What Is Infinite Banking Concept

If you need life insurance policy, right here are some important suggestions to take into consideration: Think about term life insurance. Make certain to go shopping about for the best price.

Copyright (c) 2023, Intercom, Inc. () with Reserved Font Call "Montserrat". Copyright (c) 2023, Intercom, Inc. (legal@intercom.io) with Booked Font Call "Montserrat".

Wealth Nation Infinite Banking

As a certified public accountant focusing on realty investing, I have actually brushed shoulders with the "Infinite Financial Idea" (IBC) much more times than I can count. I have actually also talked to experts on the topic. The main draw, apart from the apparent life insurance policy benefits, was constantly the idea of accumulating cash worth within an irreversible life insurance policy plan and loaning against it.

Sure, that makes sense. However truthfully, I always assumed that cash would certainly be better spent straight on investments instead of funneling it via a life insurance policy policy Up until I discovered just how IBC could be incorporated with an Irrevocable Life Insurance Policy Trust (ILIT) to produce generational wide range. Allow's start with the fundamentals.

How Do I Become My Own Bank

When you obtain versus your policy's cash money worth, there's no set settlement schedule, giving you the liberty to take care of the lending on your terms. At the same time, the cash value proceeds to expand based on the policy's warranties and returns. This setup allows you to gain access to liquidity without interfering with the long-lasting growth of your plan, offered that the finance and passion are handled intelligently.

As grandchildren are birthed and grow up, the ILIT can purchase life insurance coverage policies on their lives. Household members can take lendings from the ILIT, using the cash value of the policies to money financial investments, begin services, or cover major costs.

A critical facet of handling this Family members Financial institution is making use of the HEMS criterion, which stands for "Health, Education, Upkeep, or Support." This guideline is often included in trust fund contracts to route the trustee on exactly how they can disperse funds to recipients. By adhering to the HEMS criterion, the trust fund guarantees that distributions are produced important requirements and lasting assistance, protecting the count on's possessions while still offering member of the family.

Boosted Versatility: Unlike inflexible financial institution lendings, you regulate the payment terms when borrowing from your own plan. This allows you to structure settlements in a manner that aligns with your company cash money flow. allan roth bank on yourself. Improved Cash Circulation: By financing organization expenses via plan fundings, you can potentially liberate money that would certainly or else be locked up in standard financing payments or tools leases

He has the exact same tools, yet has also developed extra money value in his policy and received tax obligation advantages. And also, he currently has $50,000 available in his policy to utilize for future opportunities or expenses., it's vital to view it as more than just life insurance.

Banking Life Insurance

It has to do with developing a versatile funding system that provides you control and supplies numerous advantages. When utilized tactically, it can match various other financial investments and service methods. If you're captivated by the possibility of the Infinite Financial Concept for your organization, below are some steps to consider: Inform Yourself: Dive much deeper right into the principle with credible books, seminars, or appointments with knowledgeable professionals.

Latest Posts

Can Defi Allow You To Be Your Own Bank? - Unchained Crypto

Can You Be Your Own Bank

Royal Bank Visa Infinite Avion Travel Rewards